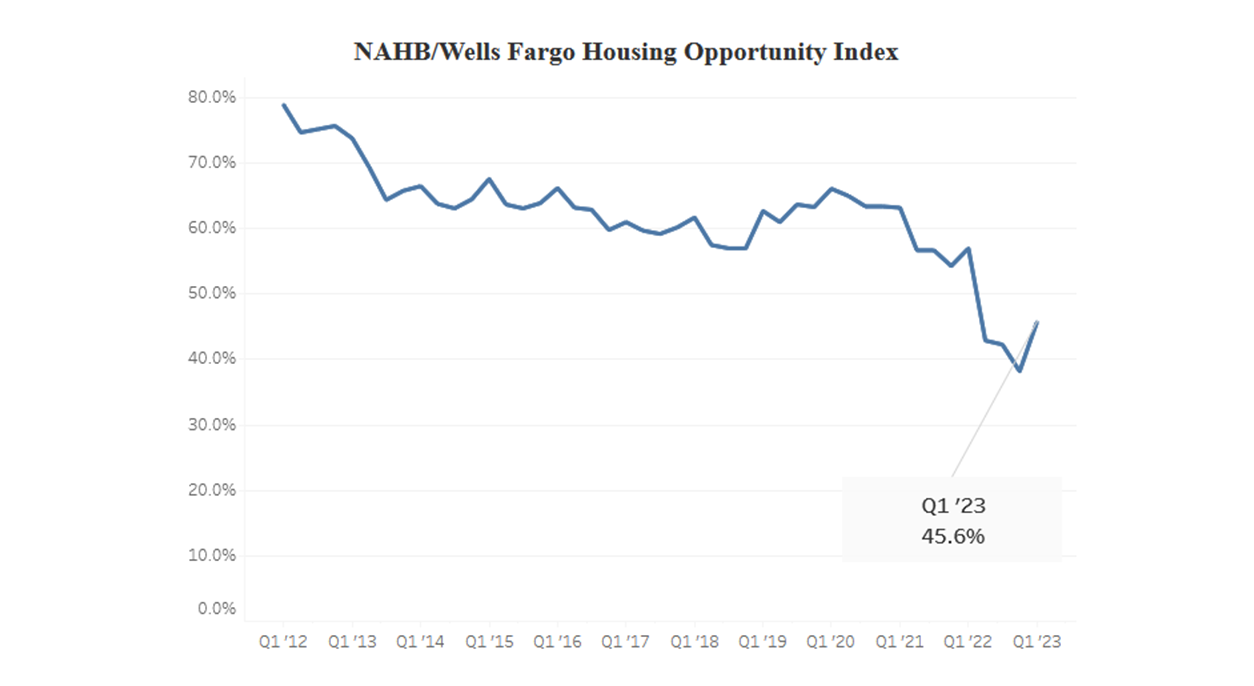

Housing Affordability is Rising.

As the latest NAHB/Wells Fargo Housing Opportunity Index just showed…housing affordability is rising! The NAHB/Wells Fargo Home Opportunity Index tracks the changes in home affordability each quarter. According to NAHB’s website, the results for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income based on standard mortgage underwriting criteria. Therefore, there are really two major components — income and housing cost.

The results for Q1 2023 showed that 45.6% of new and existing homes sold between the beginning of January and the end of March were affordable to family earning the U.S. median income of $96,300. This was an increase from 38.1% for Q4 2022, which was the lowest level since NAHB began consistently tracking affordability in 2012. Although this current reading is still down significantly from one year ago (56.9%), it is the largest quarter-over-quarter increase in the history of the index.

The Denver metro area (Denver-Lakewood-Aurora) posted a 34.9% affordability, up 10.4% from Q4 2023. The metro area ranked 161st out of the 234 markets in the index. This would indicate that Denver is in the lower one-third of all markets in home affordability.

The top 5 most affordable metro areas with a population over 500,000 in 2022 were:

1 Lansing-East Lansing, MI

2 Scranton–Wilkes-Barre, PA

3 Rochester, NY

4 Toledo, OH

5 Pittsburgh, PA

The least affordable 5 major housing markets (all 5 in California) were:

1 Los Angeles-Long Beach-Glendale, CA ^^^

2 Anaheim-Santa Ana-Irvine, CA ^^^

3 San Diego-Chula Vista-Carlsbad, CA

3 San Francisco-San Mateo-Redwood City, CA ^^^

5 San Jose-Sunnyvale-Santa Clara, CA

For markets under 500,000 people, Cumberland, MD-WV topped the list of the most affordable, while Napa, CA topped the list of least affordable. Furthermore, 8 of the top 10 cities in the least affordability category are in California. Overall, Denver metro area (Denver-Lakewood-Aurora) came in ranked 161st out of the 234 housing markets in this index. Basically, this indicates Denver is in the lower one-third of all housing markets when it comes to affordability.

Although housing affordability is rising, buyers who have been waiting to buy must understand that with our current inventory situation, it will not take a huge drop in interest rates to move a lot of buyers off the sidelines. With new listing data tracking behind last year for the past 11 months, we are still in a market being driven by supply constraints. So, for buyers who want to buy a home, NOW is the best time to start!

Visit http://nahb.org/hoi for more information and historical data.